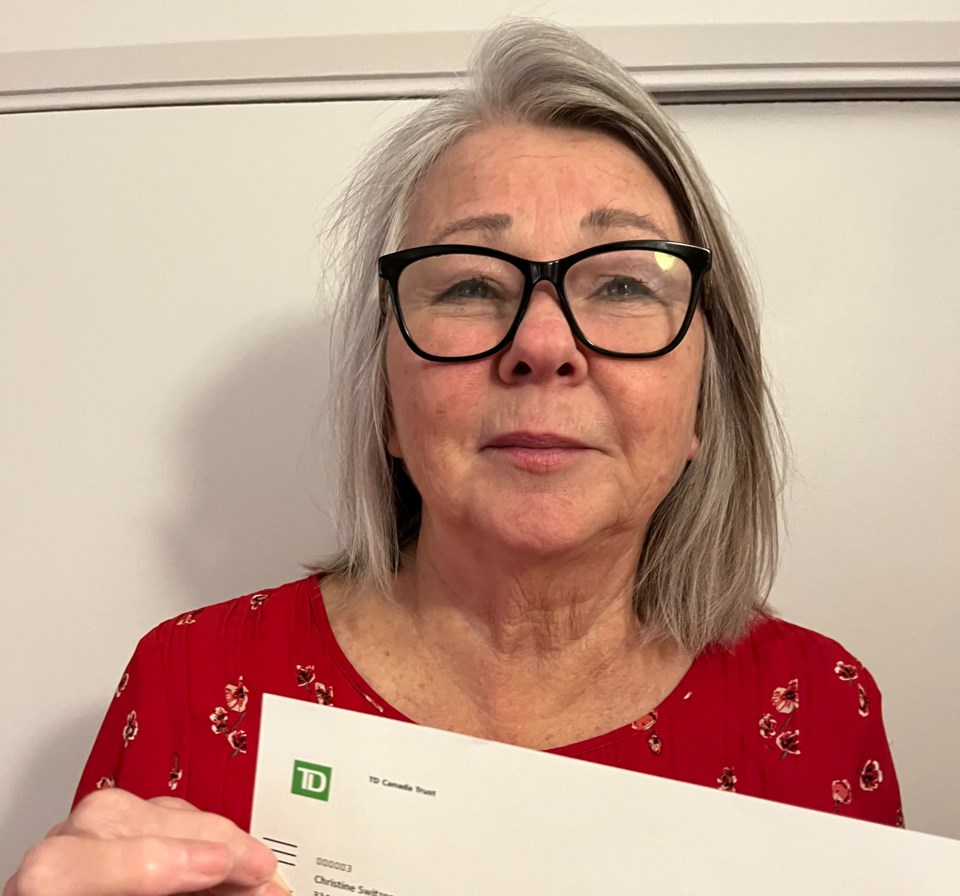

Chris Switzer has sworn off e-transfers.

The Midland woman was recently the victim of a $3,600 fraud through an elaborate scheme involving the black web.

Everything started out innocently enough with Switzer and her husband deciding to get some work done on the front porch of their home.

They had selected local landscape contractor Dustin Schimkat to do the job. They then sent him a deposit through an e-transfer to begin ordering the materials needed for the job.

But somewhere along the way, the money never reached Schimkat and Switzer found herself entering the rabbit hole that is large-scale international bank fraud.

“Fraud is so prevalent now,” says Switzer, who works as a territory sales manager for a large animal health company.

“We sent it to him and asked when ‘are we going to start the job’, but he said he hadn’t received it.”

Swtizer went to the TD Bank in Midland and explained that the money hadn’t gone into Schimkat’s account.

“They kept saying it was my fault,” Switzer says, adding she then found herself going down another rabbit hole, only this time it was with the bank she had trusted with her money for many years.

“I went through three types of fraud protection (departments with TD). The bank would not help me out in any way. It was really difficult to get answers from them.

“I know they have fraud protection. But they just washed their hands of the whole thing.”

So she turned to the police and while she didn’t recover her money, she did get some answers.

According to a Southern Georgian Bay OPP, the suspect’s name is Gamaliel Ireoluwayimika, which they concluded is a fake name after having traced the fraudster to when he or she remotely deposited the money into an account in Winnipeg and then finding nothing under that name in any of the many databases they can access.

Known as spear-phishing, an officer with the force’s major frauds division was then asked to provide some insight on how this scam is run and it is quite elaborate.

According to that officer, the contractor would have at one time had his email compromised. From there, the bad guys installed a program to intercept all emails coming and going to the victim’s email account.

Adds Switzer: “He was able to piggyback on Dustin’s account. Whoever it was really knew what they were doing.”

The compromised email account is then sold on the dark web to anyone willing to pay for it. The persons who buy these compromised email accounts then sit and wait for bills or deposit requests to be sent to unsuspecting victims, the OPP note.

The bills are modified with a new email address or wire transfer number and money is stolen as it was in Switzer’s case.

“The suspects stealing the money use fake IDs to set up multiple bank accounts and mask their IP addresses when depositing the funds from the e-transfers,” police noted.

“Once the funds are deposited, they generally move the funds through a couple different accounts remotely online making it impossible to identify the suspects as they never appear in person in the financial institution."

But while the scam’s scope is impressive indeed, Switzer says she’s left disappointed by the bank’s reaction to it.

“The thing that really bothers me is how the bank takes no effort to protect their customers,” Switzer says, noting that she experienced something the complete opposite when her credit card was once compromised and the company got right on it.

“This is a very sophisticated and organized group. How the bank can come to the conclusion that I am responsible is beyond me.”

In a letter sent to Switzer, the financial institution says it has completed a review of her situation.

“Based on the results of our investigations and the previous investigations conducted, your appeal for reimbursement has been declined,” states the letter, which is signed North American Fraud Operations (Canada) TD Bank Group.

“While we recognize this may not be the response you were looking for, we have exhausted all avenues in assisting you with this matter and we hope that you understand the rationale behind our decision.”

TD corporate affairs manager Sanjana Bari says senders have some key responsibilities when it comes to e-transfers such as ensuring the email address is correct and including effective security questions and answers that only the recipient would know and not including the security question answer within the transfer or by email to the recipient.

"Each customer circumstance is different and assessed accordingly, and while we cannot speak on details of any customer case, I can confirm this case was investigated," explains Bari, who added that TD makes every effort to educate and create awareness to protect against common scams.

Bari said it's also essential that customers validate and update contact information.

"The customer should check all information is correct and up-to-date before sending funds to both new and previous contacts through e-transfer," Bari said. "Passwords should be something that only the recipient knows. This means avoiding easily obtained or guessable information like names, birth dates, places of employment, etc.

"We also provide resources and tools designed to educate customers, on our Fraud Protection and Advice hub. If a customer believes they have fallen victim to a scam or fraud, they should report it immediately to their financial institution, the police and the Canadian Anti-Fraud Centre."

But Switzer says that since banks push e-transfers as a way to pay for things and send money as gifts, they owe it to their customers to better highlight some of the potential pitfalls that may exist when it comes to using e-transfers.

And while she can afford to live with the loss, Switzer worries about others who might fall victim to this type of crime, but are living paycheque to paycheque and could be put into poverty by this kind of malfeasance.

“I would very much like to get my money back, more so the bank needs to educate their customers about the prevalence of bank fraud and how to prevent it,” says Switzer, who ended up getting the porch work completed by another contractor.

“I won’t do e-transfers anymore unless it’s to one of my daughters.”